Industrial Auction Platform for F500

Transformed a GE Capital divestiture into a thriving asset remarketing business with $2.5B under management and a digital platform supporting $150M+ in global sales.

Location:

Connecticut, United States

Role:

Co-Founder, Chief Digital Officer

Date:

2019-2023

Led the digital rebirth of a GE Capital carve-out, securing $12.5M in funding and rebuilding the business from the ground up.

As Chief Digital Officer, I architected a full-stack asset management and auction platform tailored for Fortune 500 clients — enabling capital recovery, compliance, and operational visibility across billions in equipment.

The Challenge

The legacy business, spun out from GE Capital, had decades of domain expertise but no modern infrastructure to support enterprise clients or digital scale. To thrive as an independent company, it needed new technology, new leadership, and a credible strategy to serve large corporates with rigorous compliance, audit, and capital planning needs.

My Role

Carve-Out Leadership & Capital Raise

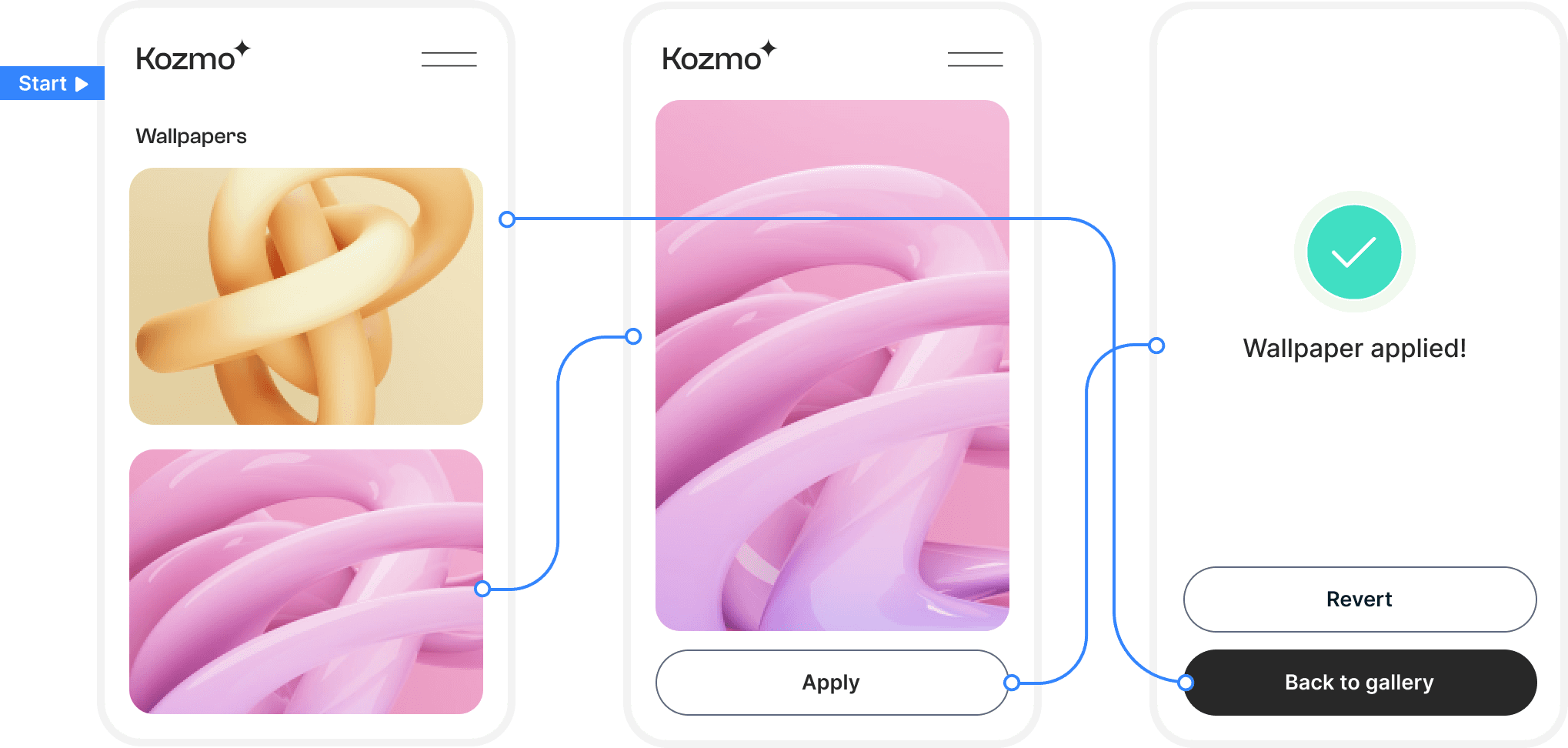

Spearheaded the transition from GE Capital, securing $12.5M in external investment to fund the relaunch. Defined and led the rebuild of core digital infrastructure, branding, and go-to-market targeting global enterprises.Platform Strategy & Execution

Delivered a secure global auction platform supporting $150M+ in transaction volume and over 10,000 users. Built in enterprise-grade features like audit logging, multi-currency bidding, and compliance overlays.Asset Management at Scale

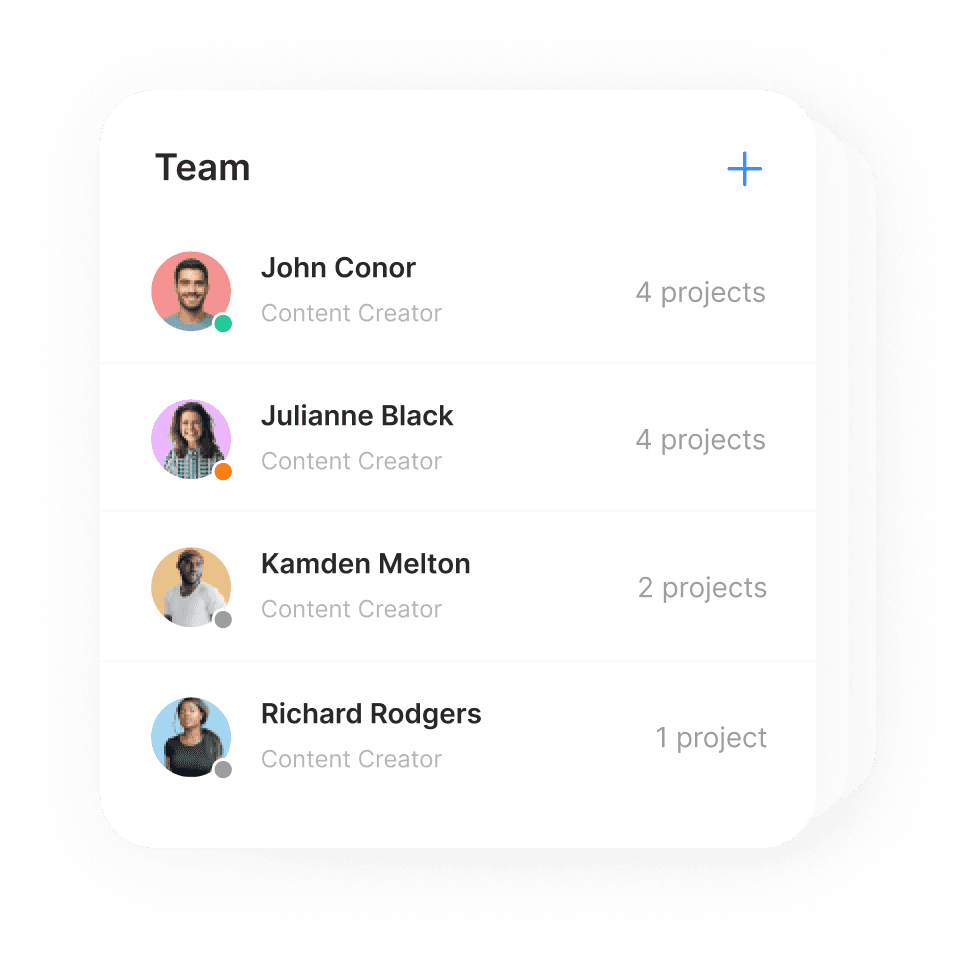

Developed and launched a lease and asset tracking platform now used to manage $2.5B in capital assets — enabling clients to oversee equipment from origination to end-of-life.Client-Facing Execution

Played an instrumental role in closing large-scale enterprise accounts by directly supporting sales efforts, demoing the platform to C-suite stakeholders (CFO, CIO, CSCO), and answering operational and technical due diligence questions.Product-Led Growth

Built multiple adjacent SaaS offerings, including surplus asset management and internal redeployment tooling for Fortune 500s. These expanded the business model beyond auctions, deepening client engagement and increasing LTV.

Outcome

The company now operates as a profitable, growing business focused on Fortune 500 clients. With $2.5B in assets under management and recurring revenue from its platform offerings, the carve-out has become a leading player in digital asset lifecycle management and remarketing — all rebuilt from scratch post-GE.